New Book Reveals How Simple Mistakes and Overlooked Tasks Can Halt Your Business Loan Application

Incomplete tasks can halt business loans mid-process. This new book, Before You Apply, offers tips to help small businesses avoid delays.

Even a minor oversight, such as letting an identification card expire, can completely halt the loan approval process.

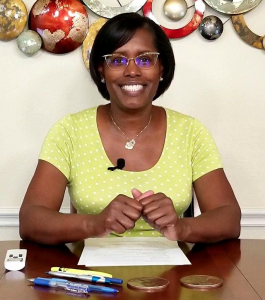

According to Before You Apply: Key Tasks for Small Businesses Pursuing Bank Loans, a new book by business consultant and expert C. Nina Ross, ensuring that all forms of identification remain valid throughout the loan process is a crucial, yet commonly neglected step. Ross’ book, now available on Amazon, provides a roadmap for small business owners seeking loans, emphasizing the need for proper documentation, a clear financial picture, and critical pre-application steps.

"Small business owners might not realize how much a single oversight, like an expired ID, can delay their financing goals," says Ross. "Throughout the business loan process, banks rely on accurate, current information to verify identity and evaluate financial history. Expired identification can raise red flags and slow things down, creating unnecessary setbacks or denial."

Ross notes that many aspiring business owners overlook this and other administrative details which can lead to significant delays or even denial of the business loan application.

Her book not only discusses the importance of up to date and valid identification, but also explains the importance of completing other actionable tasks, including accurate financial records, obtaining business legal status, understanding the impact of credit history, documenting past government loans during the application process and more.

This practical guide is aimed at solopreneurs, micro-sized business owners, and anyone who might need help navigating the complex business loan application process. With expert tips on assembling a strong application and avoiding common pitfalls, Ross provides a thorough toolkit to increase the odds of loan approval.

“Preparation is crucial, and ID expiration is a small yet critical detail that can impact a bank’s decision,” explains Ross. “In a lending climate where 73% of small businesses face partial or complete denials of their funding requests, having all documentation in order is essential to maintaining momentum in the loan process.”

Before You Apply: Key Tasks for Small Businesses Pursuing Bank Loans is now available on Amazon in both eBook and hardcover formats (audio book coming soon). Business owners looking to expand their business with a loan from a traditional bank can purchase this valuable resource today.

C. Nina Ross

CIRTT Consulting

nina@cirttconsulting.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Companies, Conferences & Trade Fairs, Manufacturing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release