Indian shares logged their best session in more than four years on Monday, surging nearly 4% in a broad-based relief rally after the country reached and held a fragile ceasefire with Pakistan over the weekend after days of cross-border clashes.

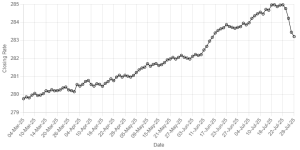

The Nifty 50 closed 3.82% higher at 24,924.70 points and the BSE Sensex rose 3.74% to 82,429.90, marking their biggest single-day gains since February 1, 2021.

Across the border, Pakistan’s benchmark KSE-100 share index rocketed 9.4%, coming off a trading halt earlier.

The de-escalation in the conflict, which erupted in earnest in the middle of last week, is unlikely to leave a lasting impact on India, the world’s fifth-largest economy, and has shifted investor focus back to economic fundamentals, analysts said.

The volatility index, nicknamed the “fear gauge”, snapped an eight-day rising streak, a sign of relief among investors.

Border conflict worry erases $83 billion from Indian equities in two days

“With the first sign of de-escalation, we are likely seeing the floodgates open in terms of foreign inflows as the global risk-sentiment is also turning positive on easing trade tensions,” said Abhishek Goenka, founder and CEO of IFA Global.

Global stocks also rose after the United States and China agreed to temporarily slash reciprocal tariffs in a deal that surpassed expectations as the world’s two biggest economies seek to end a damaging trade war that has stoked fears of recession and roiled financial markets.

All 13 major sectors in India finished higher.

The biggest gainers with a 6.7% jump were IT companies, which earn a substantial chunk of revenue from the US.

The broader small-cap and mid-caps rallied 4.2% and 4.1%, respectively.

Analysts, though, said a local holiday in some parts of the country could have led to exacerbated gains.

Comments