World’s biggest trade fair in China confronts Trump tariff ‘disaster’

Sign up now: Get ST's newsletters delivered to your inbox

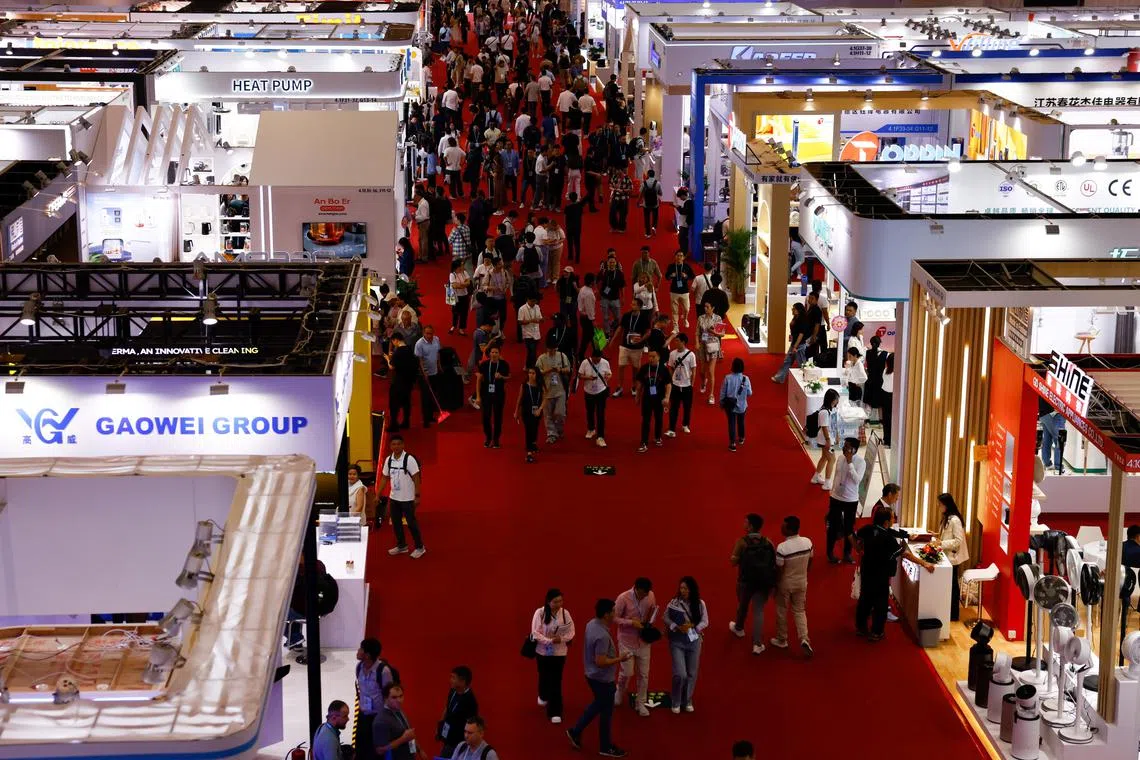

People at the China Import and Export Fair, commonly known as the Canton Fair, in Guangzhou on April 15.

PHOTO: REUTERS

Follow topic:

BEIJING - Executives at the world’s biggest trade fair in China found themselves staring into the abyss as the seams of global commerce came apart.

For many visitors to the Canton Fair, held in Guangzhou since 1957, shifting into reverse gear is hardly an option, even as prohibitive tariffs imposed on Chinese goods by the US make decoupling between the world’s two biggest economies a reality.

Take Mr Paul McGrath, who lamented the fate of his business at the exhibit.

“This is just a disaster,” he said.

For the past two years, the New Jersey resident had been planning to launch a fresh pet food maker in the US and saw the first shipment of 400 boxes leave China in January, the month when US President Donald Trump’s tariffs threw global trade into chaos.

After the ship was held up at the Panama Canal on its way to Newark, Mr McGrath’s shipment arrived a few days after the 20 per cent tariffs – announced at the start of the new trade war by Mr Trump as punishment for fentanyl trafficking – went into effect, adding US$5,000 (S$6,600) to his import bill.

Now, he is looking at multiples of that for any future shipments, and responded by raising the retail price by a third to US$399 for his product, which is wholly made in China.

Top stories

Swipe. Select. Stay informed.

Singapore

Man who rushed at Ariana Grande at Universal Studios Singapore charged with being a public nuisance

Singapore

MRT reliability dips for second straight month in Sept; North-South Line the least reliable

Singapore

Punctuality, passenger impact among LTA’s new reliability indicators; 99% of trains on time in Sept

Life

Property agents are turning to AI-generated images to sell homes in Singapore

Singapore

Man, 68, dies after slashing incident at Marine Parade condominium; 23-year-old arrested

Asia

So near yet so far: Sabah grapples with water woes ahead of election

Singapore

13 months’ jail for ex-CNB officer who pocketed nearly $1.3k in total from two men

Singapore

No Grab-GoTo merger notification yet, says Singapore competition watchdog

“We all knew tariffs were coming, but this is kind of ridiculous,” Mr McGrath said, referring to a cumulative 145 per cent in new duties now applied by the US on most imports from China.

The American presence was very thin on the ground as the trade fair got started on April 15.

The new tariffs were at the centre of every conversation.

A sales manager at one shipping company estimates about 70 per cent of its shipments to the US have been cancelled or halted after Mr Trump raised tariffs above 100 per cent. The company even recalled ships that had already left the port after US buyers called off orders.

But, while the 145 per cent has created a hard stop for exporters who cannot make a profit, Mr Trump’s 90-day reprieve for countries like Vietnam and Thailand is also spurring Chinese firms to double down on their investments in South-east Asia to circumvent the US controls.

Mr Alex Student, chief of Impulse Merchandisers – a car accessories importer based in California – said he has been turning his attention to securing deals with factories in South-east Asia.

His company’s art files for “Made in Cambodia” or “Made in Thailand” are templated and ready to go in four minutes, he added.

Canadian company Forno is also looking to move production of kitchen appliances such as fridges from China to get around the tariffs. In 2024, it imported 6,000 containers from China to North America.

It has more than six months of stock in warehouses in the US, according to company founder Jacques Houle, who said his suppliers are already moving to South-east Asia.

In about half a year, those companies should be ready to produce and the company could then restart shipments to the US, he said.

“The China-US (relations are) beyond salvation – this change of gears is irreversible,” said Mr Dan Wang, China director of the Eurasia Group.

“With the demographic changes, we are looking at the last generation that makes manufacturing overcapacity possible,” Mr Wang said. “Young generations are going to work in services. China’s future manufacturing capacity will not be in China, it’s going to be in other countries by investing in them now, like Asean and the Global South.”

It is similar to a message carried by Chinese President Xi Jinping on his first overseas trip in 2025.

During a stopover in Vietnam, he urged it to jointly oppose “unilateral bullying”, in an attempt to keep South-east Asian leaders from cutting deals with the US at Beijing’s expense.

The effects of the sudden spike in tariff rates in April are already starting to show up in the data, with China’s ports handling 10 per cent less cargo last week than the week before.

The loss in sales in April is nothing to laugh at. One company that makes appliances and a heated mattress topper said sales of 100 million yuan (S$17.9 million) to the US dried up overnight. The company has been trying to develop new customers, even attending a trade show in Germany in 2025, but so far those new customers represent only a fraction of its sales to the US.

US companies are also in the firing line. Some are taking a hit since their imports are now much more expensive. Others are in trouble because China has imposed its own tariffs or is suspending purchases of US goods, such as Boeing planes.

Even so, one American businessman at the trade show in Guangzhou was a little more sanguine. Jason, an executive for a US maker of baby products, said his company had prepared for this moment by diversifying where it makes its goods.

It opened a new factory in Malaysia about a year ago after a hard lesson learnt during the first Trump administration and seeing a chance that he would be re-elected.

The whole facility was built in China and then shipped to Malaysia. It is now exporting to the US, while made-in-China products are sent elsewhere in the world.

While that option may work for some people, the US still absorbed about 15 per cent of China’s direct exports in 2024 – and more if products going via other countries are included. The loss of that market could be catastrophic for some companies, and the fallout will likely spread to other countries.

“Tariffs indirectly affect us because it may cause some factories in China to reduce their sizes as they lose export volume,” said Mr Jacques Ivo Krause, foreign trade director for Mondial, a Brazilian home appliance company. “Maybe some will even have to close. It’s not easy to find substitutes to US imports.” BLOOMBERG