‘Big 3’ could be impacted most by tariffs, some automakers respond by halting vehicle imports

By onAnnouncements | International | Market Trends

The Detroit “Big 3” — General Motors, Ford, and Stellantis — will be most impacted by the new 25% tariffs on automotive imports, according to a new report from automotive data firm JATO Dynamics.

The debate over and implementation of tariffs has been ongoing and fluid since President Donald Trump took office in January. There is also a 10% baseline tax on imports from all countries, or up to 20% for some.

Come May 3, Trump plans to broaden tariffs to include foreign-made automotive parts.

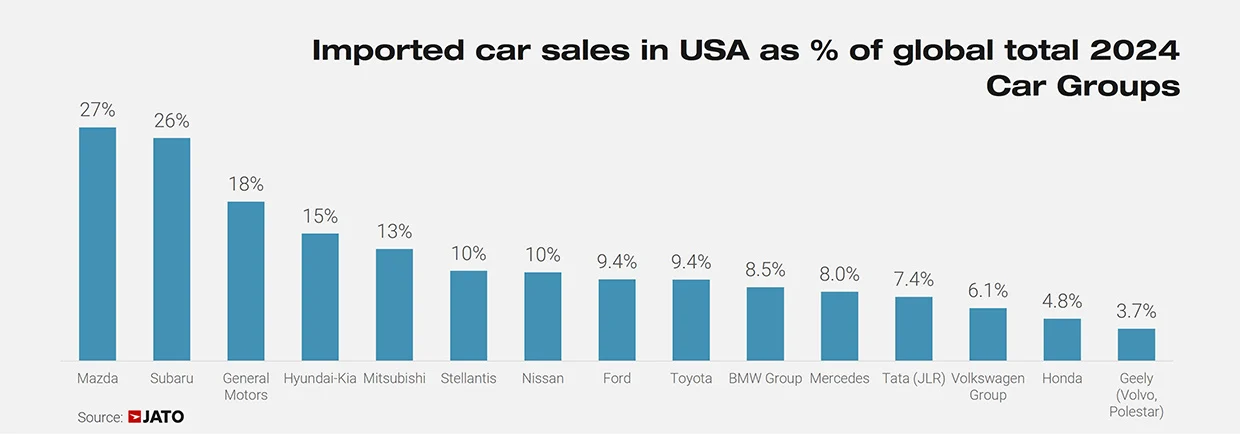

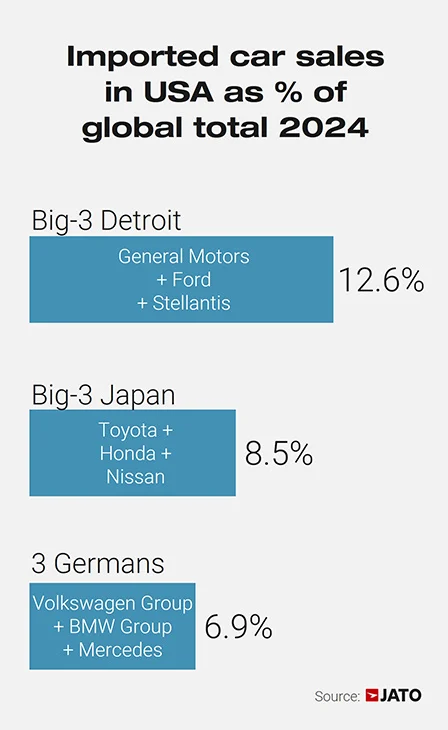

JATO Dynamics said Tuesday that Ford, GM, and Stellantis are “more exposed” to tariffs than German (VW, BMW, and Mercedes-Benz) and Japanese (Toyota, Honda, and Nissan) automakers — 13% overall versus 9% and 7%, respectively.

The Detroit News reports that Stellantis may help its suppliers pay tariff costs.

“The automaker has outlined a program in which suppliers would apply for help from the company to make monthly tariff payments to the U.S. government, according to a person familiar with the matter,” the article states. “Marlo Vitous, Stellantis’ head of purchasing in North America, laid out the plan during a meeting with suppliers in Detroit last week, the person said.”

Data from JATO show that 16.1 million new light vehicles were sold domestically in 2024, including around 6.3 million imported from Mexico, Canada, the European Union, the UK, Japan, and Korea — all of which will face a 25% tariff when exporting vehicles to the U.S., according to the report.

“In comparison, Toyota, Honda, and Nissan – the three largest Japanese brands – sold 17.9 million units globally last year,” JATO said. “Of this total, 1.53 million units were imported and sold within the US market, equating to 9%. For Germany’s Volkswagen Group, BMW Group, and Mercedes Benz, U.S. demand for their imported cars accounted for 7% of their combined global total.”

“While the 25% tariff has been applied broadly, carmakers will feel its impact in a variety of different ways,” JATO wrote. “For example, in 2024, Detroit’s ‘Big Three’ – General Motors, Ford, and Stellantis – sold approximately 1.85 million imported light vehicles in the U.S., accounting for 13% of their combined global sales.”

In response to the tariff, the New York Times reported Saturday that Jaguar Land Rover (JLR) had halted U.S. shipments of its vehicles.

In an online statement to the media, JLR said, “Our luxury brands have global appeal and our business is resilient, accustomed to changing market conditions. Our priorities now are delivering for our clients around the world and addressing these new U.S. trading terms.”

International Business Times reports that the company also said the U.S. market is important for its brands and the shipment pause is a short-term action while mid- to longer-term plans are developed.

VW’s Audi is reportedly holding back cars that arrived in U.S. ports after April 2 for the same reason. A spokesperson told Reuters the carmaker has around 37,000 vehicles in its U.S. inventory, which is sufficient for two months of sales.

Reuters has also reported that, as early as this summer, Nissan plans to shift some manufacturing of its Rogue SUV to the U.S. to mitigate the impact of the tariffs.

On Tuesday, China said it would “fight to the end” and take countermeasures against the U.S. “to safeguard its own interests” after Trump threatened an additional 50% tariff on Chinese imports, according to the Associated Press, as of Tuesday morning.

If Trump implements the new tariffs on Chinese products the taxes would reach a combined 104% for the country, including the 20% tariffs announced as punishment for fentanyl trafficking and separate 34% tariffs announced last week, the AP reports. The newly proposed tariffs follow China’s plans to implement 34% tariffs.

A Tuesday AP article noted that last week White House trade adviser Peter Navarro said the tariffs are meant to stay: “Let me make this very clear. This is not a negotiation. This is not that. This is a national emergency,” he said.

The article adds that the goal is “to get companies to produce goods in America, not abroad, bringing down longstanding U.S. trade deficits.”

By the afternoon, Trump told reporters, “There can be permanent tariffs, and there can also be negotiations.”

“Trump has called the auto tariffs ‘permanent’ and also installed a permanent 10% baseline tariff on most countries, suggesting a limit as to how much rates could fall through negotiations,” the article states.

On April 17, CEICA will host Ryan Mandell, Mitchell International’s claims performance director, in a webinar titled “Tariff Turbulence and the Collision Industry.”

According to a press release from CIECA, Mandell will talk about the impact that trade tensions and new tariffs are expected to have on the auto insurance and collision industries. He will also share the latest updates on the growing global conflict and how it is affecting carriers, repairers, and OEMs when it comes to new and used vehicle values; claim costs and cycle times; total loss thresholds; parts selection for repairable automobiles; and changes in consumer behavior.

Images

Featured image: Motor transport ship at a dock in China. (Credit: Wengen Ling/iStock)