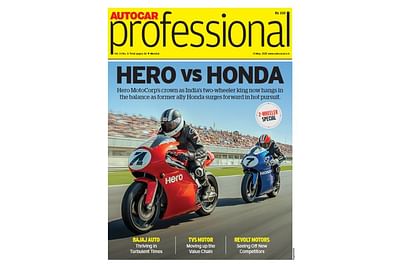

Hero MotoCorp Leads FY25 2-Wheeler Retail Sales; Market Share Dips

Hero MotoCorp’s market share declined to 28.84% during 2024–25 from 30.79% in 2023–24, while Honda Motorcycle and Scooter India’s share improved to 25.37% from 23.36%.

Despite strong competition from Honda, Hero MotoCorp retained its leadership in domestic two-wheeler retail sales during the financial year 2025.However, Honda Motorcycle and Scooter India significantly narrowed the market share gap, with Hero MotoCorp witnessing a second consecutive year of decline.

Data from the Federation of Automobile Dealers Associations (FADA) shows a close battle in retail sales.

Hero MotoCorp saw a marginal increase of nearly 1% in sales, reaching 54.45 lakh units, up from 53.97 lakh units in the previous year. Honda, on the other hand, recorded a 17% surge in retail sales to 47.89 lakh units from 40.94 lakh units.

While Hero MotoCorp maintained its top position in both retail and wholesale volumes for the full year, Honda showed stronger growth, even outselling Hero in certain months of the financial year.

Hero MotoCorp’s market share declined to 28.84% during FY25, down from 30.79% the previous year. In contrast, Honda’s share improved to 25.37% from 23.36%.

Hero faced significant pressure this financial year due to weak demand in its core entry-level motorcycle segment. However, new launches in the premium, scooter, and electric segments contributed to higher overall volumes.

The revival in scooter sales, along with incremental volumes from the Shine 100 and some premium models, helped Honda reduce the gap. Honda’s management recently stated the company is well within reach of becoming “the largest market shareholder in India."

Among the top five two-wheeler manufacturers, Hero MotoCorp and Bajaj Auto saw a contraction in market share, while Honda, TVS, and Suzuki posted gains.

TVS Motor remained the third-largest two-wheeler seller in retail terms, with sales rising 11.2% year-on-year to 33.02 lakh units. Its market share increased to 17.49% from 16.93%.

Bajaj Auto’s retail sales rose marginally by around 2% to 21.54 lakh units, but its market share dropped to 11.41% from 12.03%. Suzuki Motorcycle India saw its volumes grow 16% to 9.82 lakh units.

Royal Enfield, which crossed the 10-lakh unit mark in wholesale volume, saw its retail market share remain flat at 4.47%, with retail sales rising 7.6% year-on-year to 8.43 lakh units.

Similarly, Yamaha Motor India’s market share held steady at 3.44%, with retail volumes growing 7% year-on-year to 6.50 lakh units.

RELATED ARTICLES

India’s Construction Equipment Share May Grow 5X; Exports to Rise Mid-Double Digits in FY26

Industry leaders highlight weakening demand in SAARC nations but project strong growth in Europe, the UK, the US, and Au...

Antonio Filosa Appointed CEO of Stellantis, Effective June 23

Filosa's efforts helped solidify Stellantis’ regional dominance and included overseeing the launch of the Pernambuco pla...

Chinese Export Curbs on Rare Earth Magnets Could Disrupt Indian Auto Production: Reuters

As per Reuters, SIAM and ACMA have asked the Indian government to expedite permits and push Beijing to release shipments...

By Kiran Murali

By Kiran Murali

07 Apr 2025

07 Apr 2025

8258 Views

8258 Views

Yukta Mudgal

Yukta Mudgal